Why Is Customer Lifetime Value Important?

One of the important goals of any business is to keep increasing the value of the customers. Companies calculate Customer Lifetime Value which is a crucial metric that can accurately predict how much each customer is worth. A high Customer Lifetime Value means a customer has been retained by the company and generates substantial revenue, and is likely to bring in more revenue for the company. Each customer, if successfully retained, becomes more valuable with time. As their purchase frequency & value tends to increase, thus retained customers tend to generate more revenue for a company than the new ones and often require very less marketing to do so. Further retained customers bring in more new customers by word of mouth by voicing their good experiences, which helps improve the brand value in addition to increasing sales.

So it is essential to calculate Customer Lifetime Value for each customer. It helps to identify and monitor high-value customers for companies. Focussing on these customers by providing them with better deals and offers, and better customer support helps to increase their sales further.

You can calculate Customer Lifetime Value using the following formula:

Customer Lifetime Value = Customer Value x (average customer lifespan)

where,

Average Order Value = Total Sales / Order Count

Purchase Frequency = Total Orders / Total Customers

Customer Value = Average Order Value x Purchase Frequency

Can You Improve Customer Service Using Customer Lifetime Value?

Yes, Customer Lifetime Value can be a key metric to judge the effectiveness of the customer service of a company. A higher overall Customer Lifetime Value would indicate that the businesses are retaining more customers, and they are regularly purchasing with high ticket sizes. This would indicate that these customers have a pleasant experience with the brand and can be attributed to excellent customer service being provided. In the same way, a low Customer Lifetime Value can be used to identify that customer service needs to improve. So, companies calculate customer lifetime value and make that data available to the customer service team. They can provide customized support to the customers based on customer lifetime value calculations ensuring that the high-value customers remain happy. Low-value customers also get excellent support and can be retained further.

Challenges Faced By Businesses to Provide Good Customer Service

Monitoring customer service is often a daunting task for companies due to the lack of real-time data. Usually, the people who are in charge of monitoring and managing customer service and the team need to manually compile reports from various sources like IM services, Social media platforms, Emails, SMS, Chat systems, and Cloud Telephony services to accurately track the efficiency and identify issues with the customer service. This compiling of reports is a difficult task in itself, and it takes a lot of time to prepare reports which are then analyzed, based on which, steps for improvement can be taken. This time lag is one of the biggest challenges that companies face.

Due to manual reporting of data from various sources, it is not always possible to get detailed insights like :

a. How many customers are not happy and have issues that need to be addressed?

b. How many customers were assisted where they left with a positive impression

c. How many of these customers were churned?

d. Are higher priority customer service tickets being addressed on time?

e. Is a high-value customer treated the same as a low-medium value customer?

f. Is the team efficient with resolving issues?

g. Are issues being addressed on time?

h. Is the CLTV increasing with improved customer service if not, then why?

As a result of the lack of the above insights, companies fail to address critical points like :

a. Identifying if the customer service team is adequately trained or if further training is required

b. Whether the Customer Service team is understaffed and needs to be reinforced

c. What should be the frequency in monitoring the team and creating reports?

d. What type of customers are raising more tickets?

e. What are the most common issues being brought up? Is it a technical fault or a vendor fault? f. Is it necessary to address customers with specific problems, or High-value customers, uniquely or differently?

How Daton Help in Calculating Customer Lifetime Value?

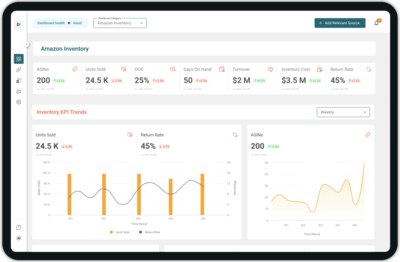

When it comes to improving customer service, daton can integrate with various tools that you may use to provide customer service like Zendesk, Freshdesk, Zohodesk, and Intercom Tawk.to, LiveAgent, Freshservice, Salesforce your social media platforms like Facebook, Twitter, Linkedin, your cloud telephony services like Exotel, Knowlarity your email tools like Mailchimp, Moosend along with your google analytics or website analytics data. Thus valuable data such as purchase history, customer behavior, cart abandonment, and wishlist data can be easily consolidated and analyzed to calculate Customer Lifetime Value effectively. Then make that data available to the customer service team so that they can quickly identify and give better support to high-value customers.

Daton is a simple data pipeline that can populate popular data warehouses like Snowflake, Bigquery, Amazon Redshift for fast and easy analytics using 100+ data sources. The best part is that you can use Daton without the need for any coding experience and it is the cheapest data pipeline available in the market. Further Daton helps you easily generate reports so that you can analyze the customer service experience of your customers and quickly generate accurate reports so that the time lag in analyzing is reduced and the overall customer service is improved.

Provide the Best Customer Services to your High Valued Customers with the help of Daton.